Offset Mortgages

An Offset Mortgage is designed to save you money over the long term. Your monthly payments will not be automatically reduced by offsetting. This is because your savings balance could vary each month, meaning your mortgage payments would also have to change each month, making budgeting complex.

Because your monthly payments remain the same you are effectively overpaying on your mortgage every single month, reducing your mortgage balance, and leading in turn to a reduction in the amount of interest you will be charged over the mortgage term.

Example:

For instance, Mr and Mrs Jones have a £100,000 mortgage but also have savings of £10,000 which they want to invest.

If they took out an Offset Mortgage, interest would be effectively charged on just £90,000 rather than the full £100,000, which may help them to pay off their mortgage earlier and could therefore save them money.

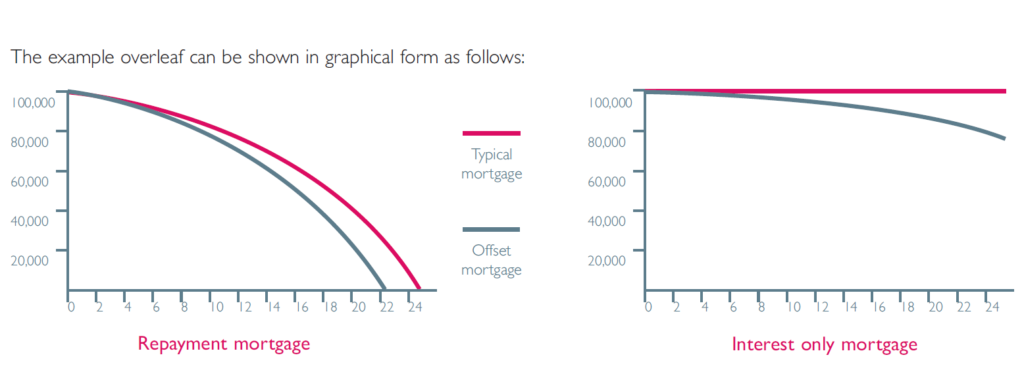

Assuming that Mr and Mrs Jones make no payments or withdrawals from their Offset savings account, with a repayment Offset Mortgage they could potentially reduce their mortgage term of 25 years by up to two years and five months and save themselves approximately £15,000*.

If Mr and Mrs Jones have a 25-year term interest-only Offset Mortgage, they could save themselves approximately £22,000*.

The example can be shown in graphical form as follows:

What if I need my savings for something else?

The Offset Mortgage is totally flexible. You can access your savings at any time.

Withdrawals must be made by cheque (which can be made payable to third parties, if required) or by electronic transfer to the bank account from which your monthly mortgage Direct Debit is paid. Log in to H&R Online.

Subject to the conditions set out above, money can be paid out against a cheque from the start of the sixth business day following the day of deposit. A business day means a day other than a Saturday, Sunday or bank holiday. Funds are available for immediate withdrawal for all other types of deposit.

The minimum balance is £250 – if you wish to go below this figure you can do so, but the balance must be taken down to nil.

How do I pay funds into the Offset Savings account?

You can add to your savings at any time as long as you do not exceed the balance of your mortgage.

You can arrange with your bank to make electronic transfers to your Offset Savings account using the following details:

Account type: Personal account

Payee’s full name: Your full name

Sort code: 40-05-30

Account number: 74575938

Reference or roll number: Your 11-digit Hinckley & Rugby savings account number, which can be found in your passbook. Without this, we will not be able to allocate the money to your account, and it will be returned to sender.

Operating your Offset accounts online

The Offset Savings account has been kept as simple as possible, so it does not offer current account facilities, but it is still quick and easy to gain access to your savings.

H&R Online allows you to view your Offset Savings and Offset Mortgage balances online. If you pay your monthly mortgage payments by Direct Debit, you can also transfer funds to your nominated bank account. In addition, you can also view details on any other savings accounts you hold with us.

Will I earn interest on my savings?

The linking of mortgage and offset savings can be very tax efficient because no actual interest is paid on your savings. Instead, mortgage interest is only charged on the net balance of your accounts. This means that you receive a notional interest credit on your savings, equivalent to the full gross rate of interest charged on your mortgage.

What happens when there is an Offset Mortgage rate change?

When there is a change in the interest rate applicable to your mortgage, your monthly payments will be recalculated based on your reduced mortgage balance to ensure your mortgage will be paid off over the term agreed originally. At this time, your monthly payments could reduce if overpayments have been made.

Should you wish to pay off your mortgage sooner you can contact us to arrange an additional monthly payment.

We have not given advice in respect of your savings or investments. We recommend that you take specialist financial advice now or in the event of any change in your circumstances during the life of the mortgage.

Not sure what you need?

Let us help

Explore our website to find what you need or click below, and get in touch with a member of our team.